How Financial Offshore Accounts Helps in Safeguarding Assets from Financial Instability

How Financial Offshore Accounts Helps in Safeguarding Assets from Financial Instability

Blog Article

Recognizing the Importance of Financial Offshore Accounts for Organization Growth

In the dynamic world of worldwide business, economic overseas accounts stand as crucial tools for business growth, offering not just better money flexibility yet also prospective decreases in transaction costs. This complexity invites more expedition into how companies can efficiently harness the advantages of offshore banking to drive their expansion efforts.

Key Advantages of Offshore Financial Accounts for Organizations

While numerous services look for affordable advantages, the use of offshore monetary accounts can give significant benefits. In addition, overseas accounts often provide much better rate of interest rates compared to residential banks, improving the capacity for incomes on still funds.

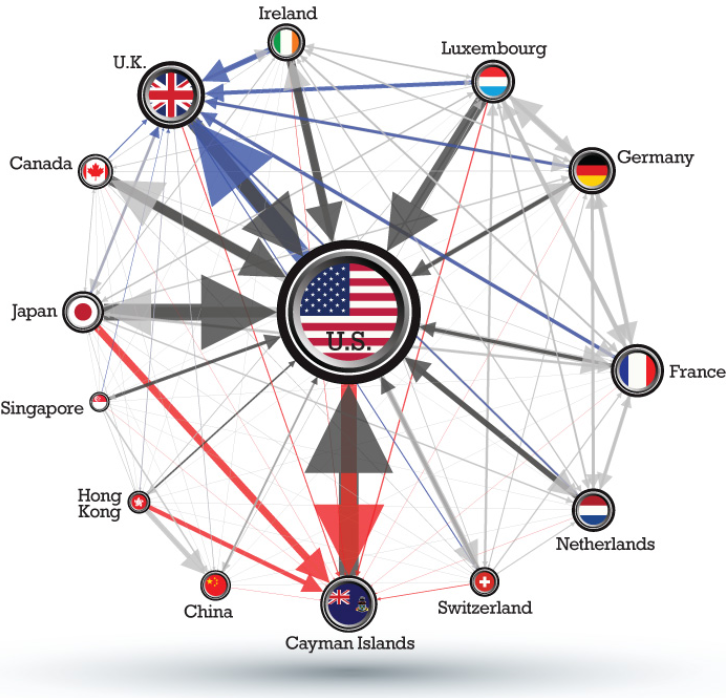

Additionally, geographical diversification integral in offshore banking can serve as a danger management device. By spreading out possessions across different territories, organizations can guard versus regional financial instability and political dangers. This strategy ensures that the firm's funding is safeguarded in differing market problems. Finally, the privacy given by some overseas jurisdictions is an important variable for services that prioritize confidentiality, particularly when handling delicate transactions or checking out new endeavors.

Lawful Considerations and Compliance in Offshore Banking

Although offshore economic accounts offer various benefits for businesses, it is imperative to comprehend the lawful frameworks and compliance needs that govern their use. Each jurisdiction has its very own collection of laws and guidelines that can dramatically impact the efficiency and legality of overseas banking tasks. financial offshore. Businesses should guarantee they are not only adhering to the regulations of the country in which the overseas account lies yet also with international monetary guidelines and the regulations of their home country

Non-compliance can result in extreme lawful consequences, including penalties and criminal fees. It is vital for services to engage with legal professionals that specialize in international finance and tax legislation to browse these intricate lawful landscapes effectively. This guidance helps ensure that their offshore banking activities are conducted legally and ethically, aligning with both global and nationwide criteria, hence protecting the company's reputation and monetary health.

Strategies for Integrating Offshore Accounts Into Business Procedures

Incorporating overseas accounts right into organization procedures requires careful preparation and strategic execution. Business need to first develop a clear goal for utilizing such accounts, whether for capital preservation, tax optimization, or global his response growth. It is vital to select the best territory, which not only lines up with the business goals yet likewise provides economic and political security. Legal advice should be entailed from the beginning to navigate the complex governing frameworks and make sure compliance with both home and foreign tax obligation laws.

Organizations ought to integrate their overseas accounts into their total financial systems with openness to maintain trust fund among stakeholders click for more (financial offshore). This entails establishing durable accounting methods to track and report the circulation of funds precisely. Regular audits and evaluations need to be conducted to alleviate any risks connected with overseas banking, such as fraudulence or reputational damages. By systematically applying these techniques, services can properly make use of offshore accounts to support their development initiatives while adhering to moral and lawful criteria.

Verdict

In verdict, offshore financial accounts are essential properties for services aiming to increase internationally. Integrating them right into company operations strategically can dramatically enhance cash circulation and align with more comprehensive business development goals.

In the dynamic globe of international business, monetary offshore accounts stand as critical devices for organization development, providing not only improved currency adaptability however also possible reductions in transaction costs.While several services seek competitive benefits, the use of overseas monetary accounts can provide substantial advantages.Although offshore economic accounts provide many benefits for organizations, it is essential index to recognize the lawful frameworks and conformity needs that govern their use. Businesses need to ensure they are not only abiding with the legislations of the nation in which the offshore account is located but also with global financial policies and the regulations of their home country.

Report this page